2020 will be remembered as a challenging year for generations to come. It will figure prominently in the pages of history books as the year financial management changed. The way in which the coronavirus has impacted the global economy in 2020 is dramatic. The unemployment rate peaked at 14.8% in April 2020, which was an all-time high. We will discuss more on these effects later in this article.

However, the availability of a few CV19 vaccines at the end of the year showed a ray of hope to the world that the battle against CV19 was starting to turn. From 2021 onwards it is going to be critical that consumers are helped in the rebuilding of their finances following the financial impact of the pandemic. We need to think about reconstructing our finances and finding better, more advanced financial coping methods for such unprecedented events in the future.

We all want a more secure future for ourselves and our families. There are many resources available online telling us how you can plan for your future. According to Forbes, you can take a few steps to ensure the smooth running of finances and work towards an independent financial future.

A future in which you will not have to rely on social assistance from the government or retirement benefits. The steps include knowing what you are saving for, setting goals, reducing your expenses, setting your savings aside each month, and spending on a budget.

Planning and Budgeting

If you have been unfortunate enough to have recently started a home mortgage, you possibly will be in negative equity right now. This means the current value of your home is lower than the amount you owe for the mortgage. Even if you sell your home, you will remain in debt.

The risk of getting into this situation is even higher for interest-only mortgage holders. Whatever situation you are in currently, you will need to plan to get out of it. A significant part of planning for the future is planning your budgets and payments.

There are a lot of resources offered by the United Kingdom’s Money and Pension Service. These include payment and budget calculators. You need to be sure that you can afford the monthly payments for your loan. In tough times like these, it is also necessary to plan your savings.

Such calculators allow you to do so. They also tell you how long your loan will last until it is fully repaid. In short, they are going to assist you in your financial decisions and in planning your life better.

Calculators that enable you to plan for your life events include a Redundancy pay calculator, Quick cash finder, Credit card calculator, Baby costs calculator, Car costs calculator, Divorce and separation calculator, Savings calculator, and Loan calculator. Yes, you are right. There is a calculator for many life events!

Another vital budget calculator is the Switch Point Calculator that tells you from a budget perspective when you should switch to a fixed-rate mortgage to avoid mortgage stress. Let us see what fixed-rate mortgages are first, and then we will move on to discuss how the Switch Point Calculator works and how it is going to be useful in the post CV19 era.

What Is a Fixed Rate Mortgage?

As opposed to a variable rate mortgage, a fixed-rate mortgage is for a property loan on which the interest rate does not change in the duration of the loan or for a fixed term. Consequently, each monthly installment you must pay remains the same. Even if the interest rate market fluctuates for any reason, the interest rate does not change.

This allows for better planning of your finances, and people who prefer predictability tend to switch earlier to a fixed interest rate loan. Read more about fixed-rate mortgages from the authoritative website Investopeida.com by clicking here.

Suppose you are facing the problem of negative equity. In that case, the best way to get out of it is usually by negotiating with your lender. Make a request for a more favorable repayment method. This can be by asking for a fixed-rate instead of a variable one.

There is an article about your rights to a fixed-rate mortgage when in negative equity on this website which you can read by clicking here. If you are wondering when to switch from a variable-rate to a fixed rate from a budget perspective, we have the answer. This is where a Switch Point Calculator plays its part. It does not take the place of getting advice early!

What Is a Switch Point Calculator, and How Does It Work?

The Switch Point Calculator is relatively simple to use. It just requires you to enter a few numbers, and then the copyrighted software produces the result. You need to enter the following details of your variable-rate mortgage:

- The current variable home loan balance in $

- Current variable Interest rate (per annum) in %

- Repayment terms in years

- Current Monthly Loan Payments in $

- Acceptable Monthly Loan Payment Increase

After you have added this information to the calculator, press the submit button. It will show you the fixed interest rate when you should switch to a fixed-rate mortgage from your budget’s perspective so that you avoid mortgage stress. To see an example of how this works, watch this video for a better idea.

In uncertain situations, you would want to know exactly how much you must pay each month, right? This calculator is going to be extremely useful in times like these. We will now see how the pandemic has affected the economy so that we can discuss in more detail the importance of this calculator in our lives.

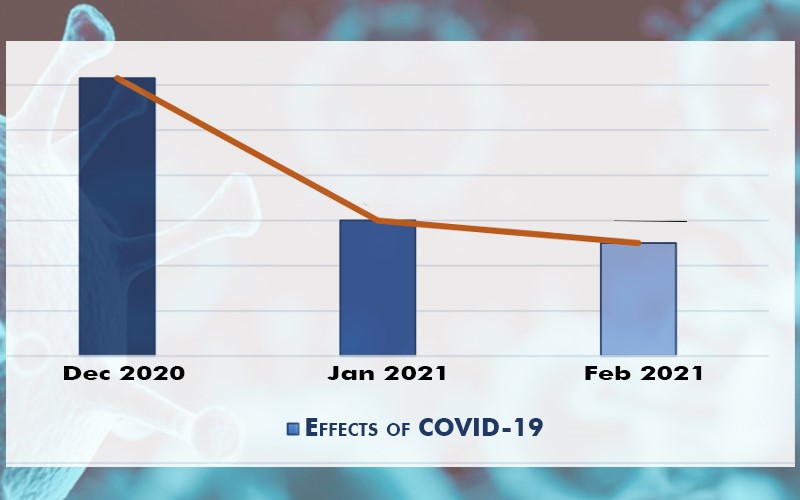

Effects of COVID-19

The coronavirus pandemic has severely impacted the global economy. According to the International Monetary Fund, the impact of CV19 has been described as a “Crisis Like No Other” in their annual report which can be read by clicking here. The severe impact on global GDP is shown in a graph format as -17.9% for World GDP Growth (quarterly percentage change).

Interest Rates

As with everything else, the pandemic has also caused turbulence in the world’s capital markets. Equilibrium interest rates plummeted in 2020, just like they went down in the 2008 global financial crisis.

The main reason for this is that the demand from the private sector has decreased while people’s savings have increased. You can read an authoritative Investopedia.com article about what happens to interest rates during a recession by following the link or clicking here.

In this scenario, where interest rates are so uncertain, it is a better option to seek advice early as to whether to switch to a fixed-rate mortgage instead of a variable-rate one. That is the goal of this article. Planning for your payments will be much easier once you know exactly how much money you need to budget for each month, helping you manage the situation better in these difficult times.

With many financial issues, the need for relevance and context is important. An article by Elena Holodny entitled “The 5,000-year history of interest rates shows just how historically low US rates still are right now” was published in 2017 by BusinessInsiderAustralia.com.au. In the article, Elena stated, “But rates remain at the lowest levels in the last 5,000 years of civilization”.

Citing a speech by Bank of England chief economist Andy Haldane, Bank of American Merrill Lynch’s Michael Harnett and his team previously shared the chart below showing just how low today’s rates are relative to those in the past. To read the article and view the chart click here.

Mortgage Industry

The effects of CV19 on the residential mortgage industry have also been devastating, to say the least. For individual homeowners, mortgage debt is a huge issue. It makes up the largest part of their finances and consumes their psychological well-being in some cases.

Especially if you face negative equity, your life will not be running smoothly because of the global pandemic if you have got behind in your home loan repayments.

On the other hand, mortgage lenders are not facing easy times either. They face multiple operational and financial challenges, unprecedented to any time in the past. Unemployment led to an overall decrease in new residential and commercial property purchases. It also caused people to delay their payments, and in some extreme cases, default on their loans.

However, if they can face these challenges effectively and come up with innovative ideas, they will recover faster from the situation and maybe even thrive better in the post-Covid world.

Technology such as a Switch Point Calculator can significantly enhance the performance of the mortgage industry. With this calculator, individual homeowners and real estate investors will know when it is time to switch to fixed interest rates as it relates directly to their budgets and warns them when to seek advice (preferably early!).

A Switch Point Calculator is the key that allows blockchain smart contracts to be developed by lenders as an automated Fintech solution.

Impact on Low-income Families

The coronavirus pandemic has had a substantial impact on low-income families compared to higher-income groups. This is mainly because low-income groups have fewer savings and hence, were less able to cope financially when the pandemic hit. Governments around the world borrowed heavily to help their citizens cope with the loss of income from employment.

If the head of the household worked in a sector severely affected, he or she might have lost their job in the second quarter of 2020. Those who did not lose their jobs faced sharp pay cuts. Thus, many low-income families have been pushed into poverty. Such families might be eligible for Universal Credit if they live in the United Kingdom. Other countries may have similar assistance programs.

Again, this makes the use of a Switch Point Calculator more than necessary. Families that have not yet fallen into poverty can plan for the rough times that are about to come. Those who have already fallen below the poverty line can work on ways to rebuild their income and consider getting loans from banks and private lenders to keep their lives moving.

This graphic from Freelancers’ Life Planning Documents shows graphically the importance of a Switch Point Budget Planner for main street citizens where ever they live:

In a report by the Institute of Employment Studies in the United Kingdom, several individuals from low-income households were asked about their future aspirations. Most of them did not sound very hopeful of better conditions in the short term.

However, others were more hopeful. They thought that if they use proper means of securing their finances, they can recover from the financial mess this pandemic has created.

The Switch Point Calculator is a flicker of hope for these individuals because it is a source of security and protection.

Switch Point Calculator: a Source of Consumer Protection?

You might ask, what is consumer protection? Well, in general terms, a consumer protection act is in place to protect the rights of buyers and sellers. The marketplace is regulated and checked if sellers are taking undue advantage of the buyers. It also protects the consumers from faults in the goods and services the seller is offering.

In this case, the mortgage industry can also have consumer protection. The rights of borrowers are protected in a way that lenders cannot take unjust interest rates. Borrowers can also be protected from unprecedented situations where interest rates greatly vary. If they switch to a fixed-rate mortgage and know how much they need to pay each month, much of their mortgage stress will be released.

A switch point calculator provides a safeguard for consumers (borrowers in this case). They can simply put in their mortgage information and find out exactly when they should make the switch at a time of record-low global interest rates.

Final Words

The main thrust of this article is to make home loan borrowers aware that you should be seeking advice early in this post CV19 era. If you live in the United Kingdom which our website has used as an example because they appear to lead the world in government financial advice and support, contact the Money Advice Service (0800 138 7777). Their advice is free and impartial.

<!– /wp:parag