This open innovation report introduces a globally accessible, AI-responsive mortgage model designed to protect homeowners and lenders from financial disruption. It includes a published process map, affordability thresholds, and embedded insurance logic for public benefit — with protections against private patenting.

🛡️ OPEN INNOVATION DECLARATION

This document and its described system — The Future-Proof Mortgage: AI-Responsive Loans That Adjust to Life — is hereby placed into the public domain by John Richard Cosstick on 8th April, 2025 as part of a formal open innovation release.

🔓 License: Creative Commons Attribution-NonCommercial 4.0 International (CC BY-NC 4.0)

📅 Timestamped Submission: This declaration is included with submission to the UN AI for Good Impact Initiative and is published alongside supporting work on TechLifeFuture.com and Mindhive.org.

🏠 What This Model Is Trying to Achieve

The Future-Proof Mortgage is a global housing innovation designed to adapt to financial shocks caused by artificial intelligence and economic change. It uses open banking data and AI signals to trigger mortgage restructuring automatically — making loan repayments affordable, preventing foreclosures, and protecting lender capital.

This approach supports social stability, long-term homeownership, and middle-class resilience during rapid labor disruption and inflationary pressures. It aims to avoid another Global Financial Crisis by reimagining what a modern, ethical, responsive mortgage should look like.

🔄 How It Works

- Monitors borrower income using open banking data or manual reporting

- Triggers a Switch Point if repayments exceed a set affordability threshold (e.g., 35% of income)

- Automatically converts from variable to fixed rate to stabilize payments

- Detects AI-driven job disruption or income loss and extends the loan term

- Applies embedded insurance: negative equity, disability, death, AI Disruption cover

📐 Repayment Formula (Explained)

Let: P = Principal (Amount Borrowed) r = Monthly Interest Rate n = Loan Term (Months) I = Monthly Income B = Affordability Threshold (e.g., 0.35) Standard Formula: M = P × [r(1 + r)^n] / [(1 + r)^n - 1] Switch Trigger: If M > B × I → Switch to Fixed Rate Post-switch: M_fix = P_rem × [r_fix(1 + r_fix)^n_rem] / [(1 + r_fix)^n_rem - 1] Total with insurance protections: M_total = M + C_dis + C_death + C_ne + C_ai

🧑💼 Case Study: Maria Tran

Maria, a teacher, saw her income drop 10% due to AI-induced workforce restructuring. The system triggered a Switch Point, shifted her loan to a fixed rate, and automatically extended her loan term by 3 years to reduce repayment pressure. Insurance protections covered the shortfall, keeping her in her home with dignity and stability.

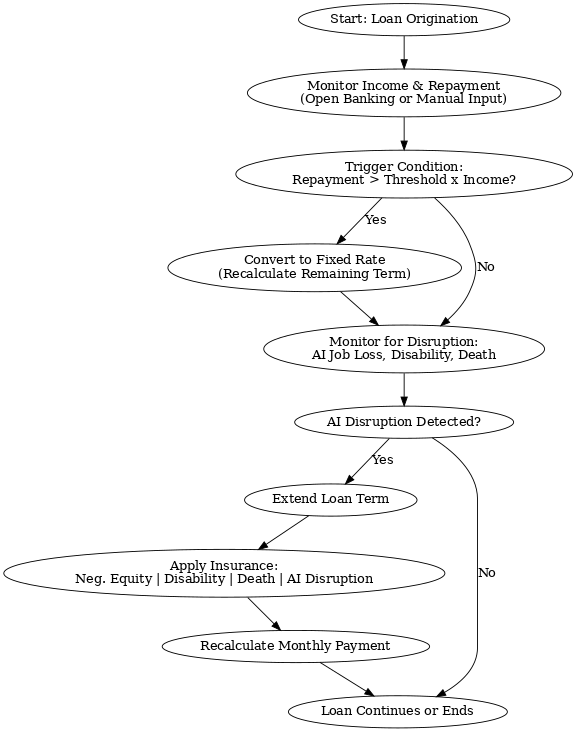

📊 Full Lifecycle Process Map: Mortgage Response to Income Stress & Disruption

This visual outlines the step-by-step transformation of a mortgage based on real-time income and life event triggers.

📈 Who Can Use This and Why It Matters

- 🔵 Governments – Stabilize homeownership & mitigate systemic risk

- 🟢 Lenders – Reduce default rates & maintain portfolio health

- 🟣 Borrowers – Maintain housing security even after income shock

- 🟠 Insurers – Offer embedded protections within mortgage products

🌍 Call to Action for UN AI for Good and Global Partners

We invite collaboration from:

- 🌐 UN AI for Good Impact Initiative participants

- 🤝 Mindhive public innovation networks

- 🏦 Central banks and housing finance agencies

- 🔬 AI researchers and policy designers

Let’s build a globally adaptive housing finance system that meets the needs of the AI age. Share your insight, feedback, or use #FutureProofLoans to join the conversation.

This is an open-source model for global public good, released under CC BY-NC 4.0 license. Help evolve it — ethically, inclusively, and collaboratively.